Tax Blog

Tips to help you prepare for tax season

The latest tax tips and news from MTS Tax Preparation, Planning, and Financial Literacy

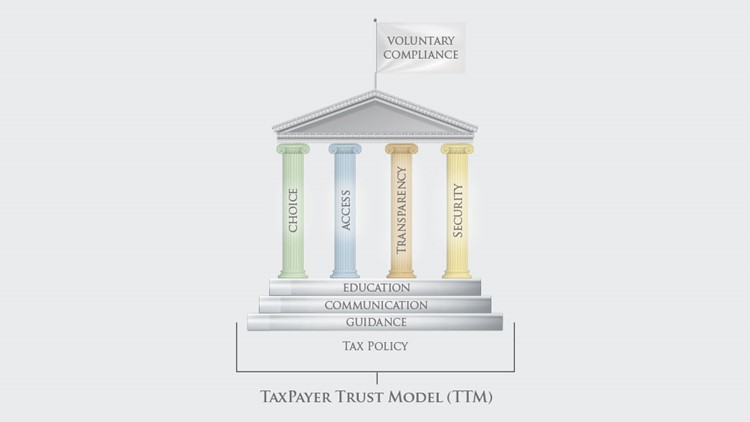

ETAAC Lays Out its 2023 Recommendations

The ETAAC released recommendations to improve electronic income tax filing in their 2023 annual report. The document asks the IRS to update their procedures and details legislation and other recommendations for both Congress and the IRS. Drake Software covers their Taxpayer Trust Model and the proposed changes in our recent blog post.… Read more about ETAAC Lays Out its 2023 Recommendations (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Calif. Disaster Victims Report Confusion Following IRS Notice

Weeks of record flooding and mountain snows brought on by an “atmospheric river” in California resulted in a federal disaster declaration from the Federal Emergency Management Agency (FEMA). While disaster victims received tax relief from filing and payment deadlines, some were confused after receiving notices from the Internal Revenue Service.… Read more about Calif. Disaster Victims Report Confusion Following IRS Notice (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Real Facts About Bogus Claims for the Employee Retention Credit

A new wave of advertising is churning up interest in a tax credit intended to help businesses and non-profits that tried to retain their employees during the COVID-19 pandemic. However, the ads on TV and radio, online, and even direct mail leave out a critical fact: most of the promoters’ clients won’t qualify for the credit.… Read more about Real Facts About Bogus Claims for the Employee Retention Credit (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Direct File Pilot to Debut Next Tax Season

The Internal Revenue Service is moving ahead with a program that will offer taxpayers a new option on for filing their 2023 returns next year. Dubbed “Direct File,” a scaled-down version of the full program will allow taxpayers to file online for free, using an IRS-run website.… Read more about Direct File Pilot to Debut Next Tax Season (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Time Running Out to Claim Tax Year 2019 Refunds

The Internal Revenue Service says it has almost $1.5 billion in leftover tax refunds for 2019 taxpayers who haven’t filed—but the time remaining to claim this money is slipping away.… Read more about Time Running Out to Claim Tax Year 2019 Refunds (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Drake Software Wins 8 Categories in 2023 CPA Practice Advisor Readers’ Choice Awards

Every year, CPA Practice Advisor asks readers to vote on the technology—both software and hardware—they trust the most. Just one day before the individual filing deadline, the publication announced the results of its nineteenth annual Readers’ Choice Awards, which included more than 5,000 respondents.… Read more about Drake Software Wins 8 Categories in 2023 CPA Practice Advisor Readers’ Choice Awards (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…